You believe in justice. You show up, speak out, and push for change in your community and workplace. But what if your retirement savings are silently working against everything you stand for?

Most workplace retirement plans invest in funds that represent business-as-usual: fossil fuels, private prisons, and corporations that perpetuate systemic bias, reinforce structural racism, widen the gender pay gap, and inflict harm on historically marginalized communities. This is a story we’re hearing more and more, and it’s exactly why we’ve created Social Justice Funds.

Three new social justice issues rated

Through our Invest Your Values platform, we’re helping individuals and workplaces shift their personal finances away from harm and toward justice, equity, and long-term impact. The new tool allows investors to easily see in one place if your 401(k) options or personal portfolio is invested in:

- Companies that promote diversity in their marketing but fail to back it up with real action – such as reporting on workplace diversity initiatives, policies, or disclosure practices.

- Companies that made public statements in support of racial justice but fail to follow through with meaningful action.

- Companies that lack comprehensive policies, equitable benefits, or transparent reporting to ensure LGBTQ+ employees feel safe, respected, and supported.

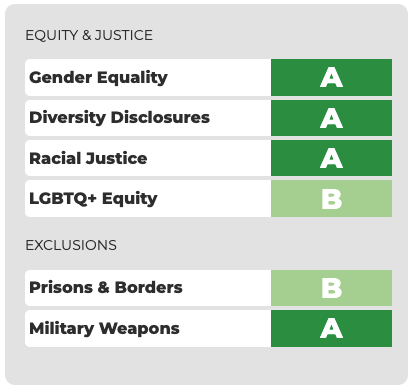

These new ratings join our existing Invest Your Values ratings on gender equality, prisons & borders, and military weapons, giving people a wide view into the social justice impact of their savings.

An example of a Social Justice Funds report card.

Aligning profits with purpose

These tools are about offering investors insight into the social justice impact of their portfolios, alongside traditional metrics like financial returns. The search page helps you find mutual funds and ETFs that match your values and have financial returns that beat the market. A growing body of evidence shows a strong connection between diverse management and corporate financial success, making it clear that focusing on social justice matters to both businesses and investors. The new fund results align with previous research, showing a statistically significant positive correlation between social justice grades and long-term financial performance.

Investors can use Social Justice Funds to search for funds that earn the highest annualized returns, and the highest grades for the issues that matter to them. Each fund can be compared to benchmark indexes like the S&P 500 on financial performance and sustainability results.

The next power lever for social justice activists

In the face of recent political pressure, many U.S. companies have scaled back or eliminated their DEI programs. While these actions may have appeased political opposition to DEI, companies have alienated their consumers sparking swift boycotts, costing some of them billions in revenue and share value.

These boycotts have made it clear that collective individual action has the power to hold companies accountable. But consumer choices are only one piece of the puzzle. For many of us, our biggest financial influence isn’t at the cash register — it’s in our retirement plans. By aligning 401(k)s and other retirement plans with social justice values, investors can send an even stronger message: companies must remain committed to social justice or will face financial and reputational consequences.

Taking action

As You Sow’s Invest Your Values suite of tools are free to use: We built them to encourage investors to move their hard-earned savings to funds that are aligned with their values. Not sure where to get started? Check out our action toolkit explaining how individuals can talk with their financial advisor or retirement plan manager to add sustainable investment options.