There are two things that generally matter most to people interested in fossil free investing: investing less in fossil fuels and other environmentally and socially harmful business models, and financial returns. So how do you know which funds check both boxes?

Fossil Free Funds and all of the Invest Your Values suite of tools have just added a new way to compare funds side-by-side to find those that best align with your values and your financial requirements. In addition, we’ve made it easy for you to take our data with you by offering a spreadsheet format for results.

Easy to compare funds

Our newest feature enables you to select up to four funds from your search results by simply checking the compare box for a selected fund. Funds are compared across all environmental, social, and governance (ESG) issues tracked by As You Sow’s Invest Your Values tools.

In this example, we’ve chosen a basic S&P 500 index fund from BlackRock (IVV), a “fossil fuel reserves free” version of that same index from State Street Global Advisors (SPYX), and a fossil free fund offered by a member of sustainable investing group US-SIF, the Parnassus Core Equity fund (PRBLX). (You can see this comparison in your browser here.)

What should we expect when comparing these funds? Both the BlackRock fund and the State Street fund are S&P 500 index funds, so their ESG grades and financial performance should be roughly the same. But the State Street fund is “fossil fuel reserves free,” so we might expect it to have better grades than the BlackRock fund on climate change issues. Meanwhile, the Parnassus fund is an actively managed fund that doesn’t track the S&P 500, so the results could be quite different across ESG and performance.

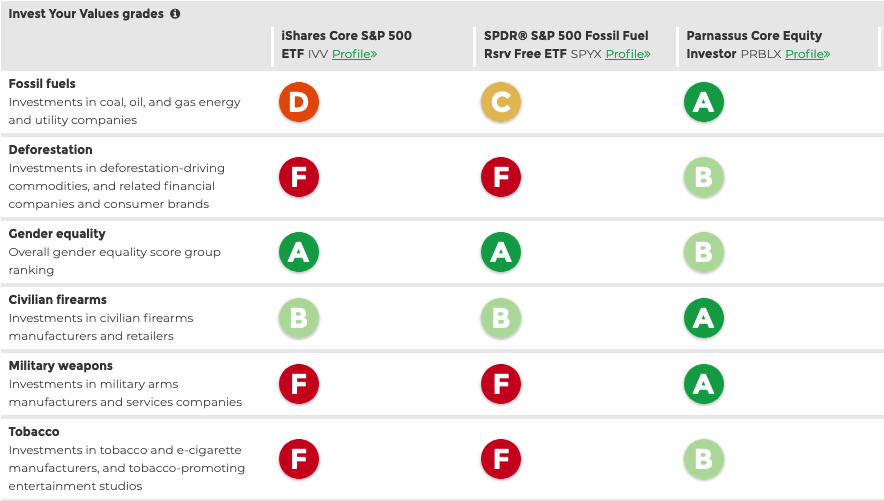

Comparing fund ESG grades

How can we interpret these results? Each fund is given a grade for each ESG issue. On the left is the BlackRock basic S&P 500 index fund, in the middle is the “fossil fuel reserves free” State Street fund, and on the right is the sustainable Parnassus fund.

As expected, the grades for the two funds that track the S&P 500 are roughly similar, except that the “fossil fuel reserves” free version has a C grade for fossil fuels instead of a D. There are only two issues where the S&P 500 funds get an A or B grade: gender equality, and civilian firearms.

In contrast, the sustainable Parnassus fund earns an A or B grade for each of the six issues we currently grade. With an A grade in fossil fuels, this sustainable fund is more fossil free than the “fossil fuel reserves free” S&P 500 fund.

But what about returns? We’ve written about the myth that fossil free investing means sacrificing financial performance. Does this apply to the funds compared here?

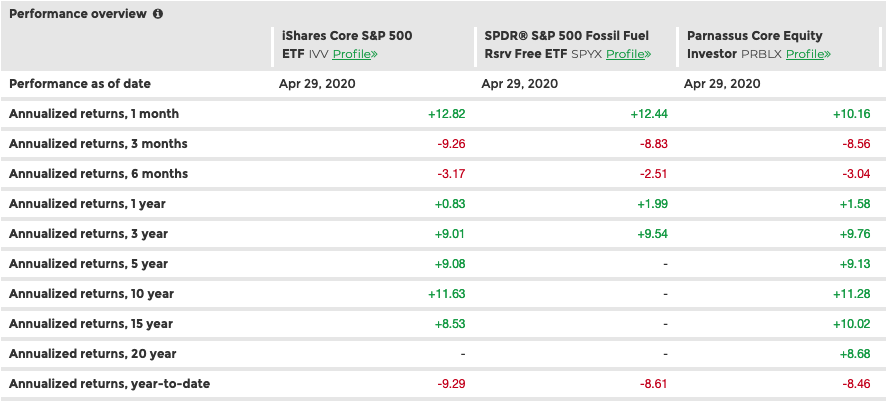

Comparing financial returns

The new compare funds feature on all Invest Your Values sites will enable you to see how fund options you are considering for your portfolio match up against other funds. Like the broader markets, all three of the selected funds are down year-to-date and roughly flat over the past 12 months (as of Apr. 29). The basic S&P 500 fund is doing the worst year-to-date (-9.29), the “fossil fuel reserves free” S&P 500 fund is doing slightly better (-8.61), and the sustainable Parnassus fund is outperforming both (-8.56)*.

*All returns data is as of April 29, 2020. Returns are provided by Morningstar and account for expense ratio but are not adjusted for sales charges.

Over the past 12 months, again the basic S&P 500 fund is lowest (+0.83), the Parnassus fund is next (+1.58), and the “fossil fuel reserves free” is outperforming (+1.99). Over the past one month, the basic S&P 500 index fund outperformed the other two funds, but that rebound still puts the basic index fund behind the “fossil fuel reserves free” index fund and the sustainable actively managed fund over the past year.

Over the past three years, again the “fossil fuel reserves free” index fund outperformed the basic S&P 500 fund, and the Parnassus fund outperformed both. The “fossil fuel reserves free” S&P 500 fund doesn’t have a track record beyond three years, but the sustainable Parnassus fund outperformed the S&P 500 fund over five years, slightly underperformed over 10 years, and outperformed over 15 years.

Spreadsheet format

If you want to drill down further into tools, we now have a monthly spreadsheet available for download provided with our methodology that includes the list of companies we screen funds for, and the list of funds tracked by our tools, including their ESG grades and financial performance data.

These new features are designed to make it easier for you to find the funds that best match your values and your investing circumstances. Moving your money is your power. Fossil Free Funds can help get you there. Get started today at fossilfreefunds.org.