Clean200 screening comes to Fossil Free Funds

Before we built Fossil Free Funds, there wasn’t really a great way for people to green their personal portfolios and 401(k) plans. If you’ve decided to divest from fossil fuels, you’re protecting yourself from the risk that fossil fuel stocks will go down as the world transitions away from dirty energy.

But divestment isn’t the end - there’s a way to double your impact. You can make sure the money you’ve taken out of fossil fuels is working towards building a clean energy future by reinvesting in renewables and other clean technologies.

To show you if your funds are investing in clean energy leaders, As You Sow partnered with Corporate Knights to create the Clean200, a list of 200 of the largest companies making significant revenue from clean technology.

Now, for the first time ever, there’s a way to measure how much of your savings are helping build wind turbines, solar panels, and other low-carbon technologies.

Investing in a clean energy future

With Fossil Free Funds, you can see if your fund is invested in fossil fuel companies like the Carbon Underground 200, the 200 companies with the largest fossil fuel reserves. Think of the Clean200 as the inverse of the Carbon Underground 200.

The Clean200 is made up of the biggest 200 public companies ranked by green energy revenues, using Bloomberg New Energy Finance data. Every company on the list has a market cap over $1 billion, and Clean200 companies have a collective value over $1.8 trillion.

The world is currently adding twice as much clean power capacity as coal, oil, and gas combined, according to Bloomberg New Energy Finance. On the Clean200 list you’ll find companies working on renewable energy, but also energy efficiency and other low-carbon “cleantech”.

In its first full year and a half of live performance, Clean200 companies generated a total return of 32.1%. That’s almost double the 15.7% for its fossil fuel benchmark the S&P 1200 Global Energy Index.

Find out what’s in your portfolio

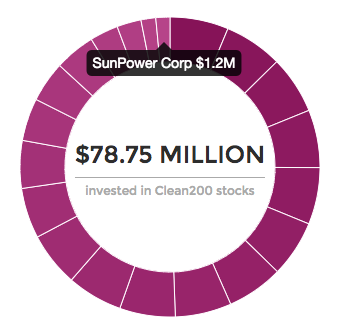

Each fund on Fossil Free Funds has a Clean200 tab that shows you:

- Which Clean200 companies the fund invests in

- The overall amount of the fund invested in Clean200 companies

- Whether the fund has more money in the Clean200 or the Carbon Underground 200 carbon reserve owners

It’s a simple way to see whether a fund is betting your dollars on the clean energy transition, or old dinosaurs like coal, oil and gas.

You can also sort funds to find options with the highest levels of Clean200 investments. For example, the PowerShares Cleantech Portfolio [PZD] has nearly 50% of assets invested in Clean200 companies – and it earns all five “fossil free badges” offered by Fossil Free Funds.

Each fund has a Clean200 profile showing how much it has invested in different Clean200 companies.

The data gets updated regularly

Corporate Knights and As You Sow update the Clean200 list bi-annually, and the mutual fund data is updated on Fossil Free Funds every month. We publish the entire list of 200 companies publicly for anyone to use.

Head over to Fossil Free Funds to get started measuring the clean energy impact of your savings.