The Vanguard Total Stock Market Index Fund (traded as VTSAX, VSMPX, VTI) is one of the most popular mutual funds, with more than $1.2 trillion in Assets Under Management (AUM). While returns are usually the primary concern for investors, some impact investors may be surprised to find that their investments are fueling the climate crisis.

What companies are in VTSAX?

If you search VTSAX on fossilfreefunds.org, our free online tool that analyzes the climate risk of mutual funds and ETFs, you’ll find that VTSAX received an F grade with 8.56% exposure to fossil fuel companies. The total AUM in fossil fuel stocks for VTSAX equates to $103.11 billion. VTSAX holds 211 fossil fuel company stocks, including Chevron, ExxonMobil, and ConocoPhillips. But how does this compare to alternatives? Are there cleaner funds on the market with comparable or better returns?

What is better than VTSAX for fossil free investors?

One possible alternative to VTSAX is the Vanguard FTSE Social Index Fund (VFTAX, VFTNX). This fund is a popular ESG alternative, also offered by Vanguard, and one of the more common sustainable options found in retirement plans across the U.S. On Fossil Free Funds, investors can use the “compare” feature to see that the ESG alternative avoids more environmental and social investing risk:

Compared to the Vanguard Total Stock Market Index Fund, the Vanguard FTSE Social Index Fund has lower investments in fossil fuels. Compared to VTSAX’s 8.56% exposure, the Social Index has just 0.32% exposure, and completely avoids the top 200 carbon reserve owners, and top 30 coal-fired utilties.

The Vanguard FTSE Social Index Fund also has better grades on guns, the prison industrial complex, military weapons, and tobacco. It earns A ratings for civilian firearms and military weapons, meaning it holds none of the arms manufacturers, gun makers, or gun retailers we screen for. The non-ESG fund, on the other hand, didn’t earn an A in any category.

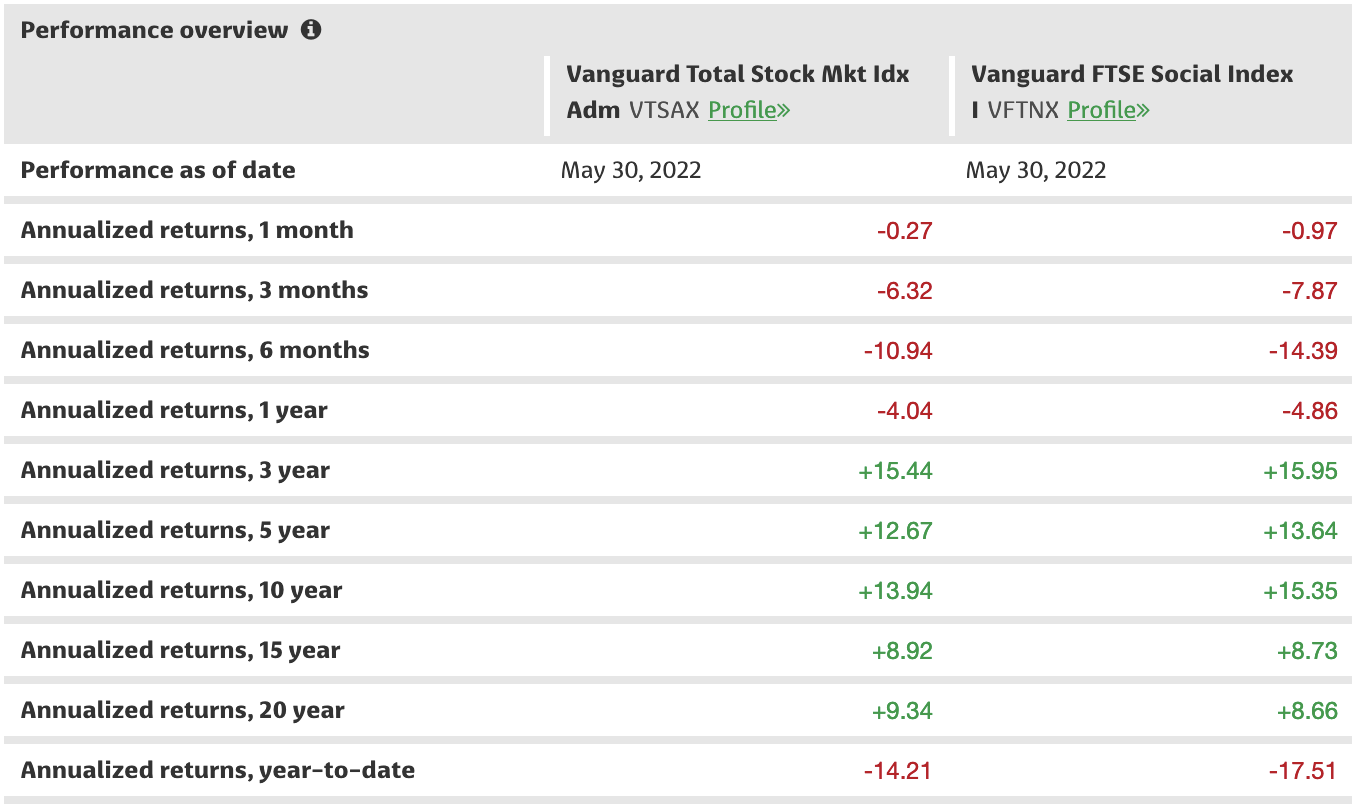

Many investors still erroneously believe that investing sustainably means sacrificing returns. How do VTSAX and VFTNX compare on financial performance?

The returns for these two funds are comparable. As of May 30, 2022, the Vanguard FTSE Social Index outperforms VTSAX over 3, 5, and 10 years.

Both of these Vanguard funds are Large Blend U.S. Equity funds. While the management fees (expense ratio) of VFTAX are slightly higher than VTSAX - 0.04 compared to 0.14 - the financial performance figures are presented net-of-fees.

Climate Risk is Financial Risk

ESG funds do not need to score all A’s to significantly diminish the climate and social impacts of your investment portfolios compared to non-ESG funds. Beyond the real-world environmental and social impacts, unsustainable investments inside funds like the Vanguard Total Stock Market Index Fund carry real financial risk.

In polls with investors broadly, more than 70% say that they would like to invest sustainably and, specifically, not in oil, coal, and deforestation. Given the threat that climate change poses to workers’ life savings, it makes sense that 401(k) and other mutual fund investors would be looking to safeguard financial security over time by mitigating climate change-related financial and economic risks.

Next steps

Employees with a 401(k) account can follow these simple steps to secure a climate safe retirement plan.

To find more funds that avoid fossil fuel investments, check out our Fossil Free Funds database.