Look inside many large U.S. corporate 401(k) plans, and you’ll find the BlackRock LifePath Index. Hundreds of big companies like Microsoft and Apple have this fund as their default investment option, directing plan contributions to them unless employees specify otherwise. Few employees are aware that these types of funds are usually heavily invested in fossil fuels, deforestation, and private prisons.

Is the BlackRock LifePath Index Series sustainable?

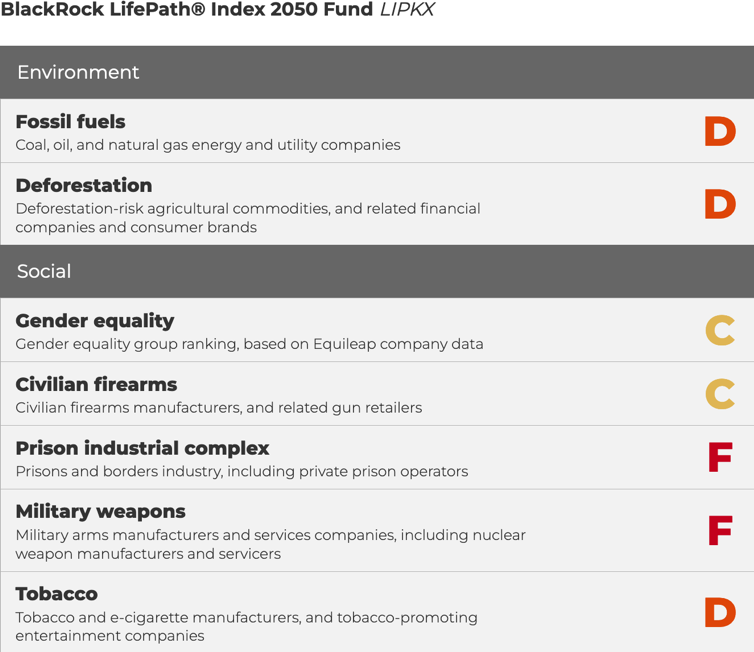

Because many target date funds like the LifePath series consist of “own the whole market” index funds, they are inherently exposed to many types of environmental and social risk. Our free online tool Invest Your Values analyzes the environmental and social impact of mutual funds, exchange-traded funds (ETFs), and 401(k)s. We found that the original BlackRock LifePath Index series scores poorly (earning a D or F grade) on five out of seven issues areas.

Do employees who have chosen the BlackRock LifePath Index series in their 401(k) plan know that they are invested in 422 fossil fuel companies like ExxonMobil and Chevron, arms manufacturers like Raytheon and Lockheed Martin, private prison operators like CoreCivic and GEO Group, and other environmentally and socially risky companies?

Investor demand for climate safe alternatives

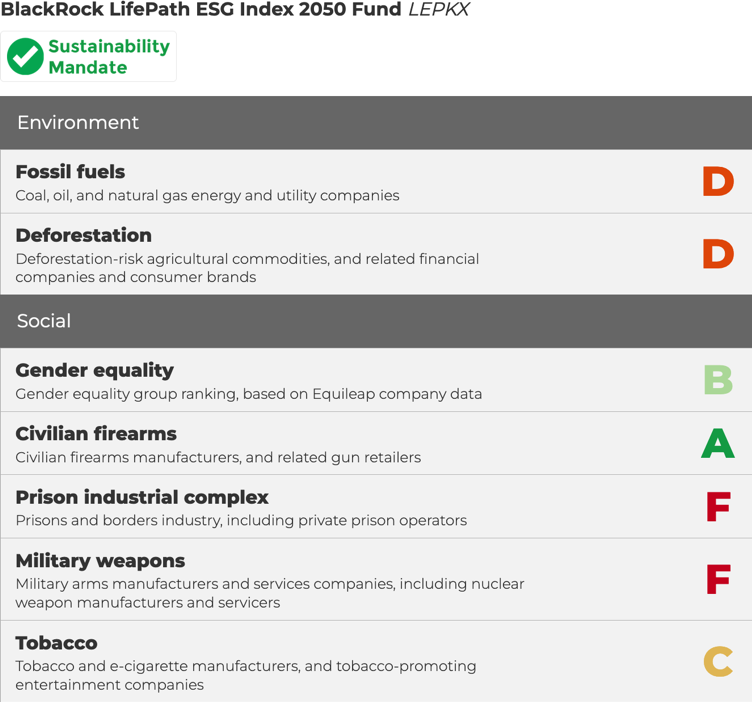

Investor demand for sustainable, climate-safe investment alternatives has spiked in recent years, leaving asset managers like BlackRock scrambling to create products that meet their clients’ demands. In 2020, BlackRock released an open letter to their clients declaring “[W]e believe that sustainability should be our new standard for investing.” To back this up, they introduced a number of sustainably-focused investments, including an ESG (environment, social, and governance) version of the BlackRock LifePath Index Series.

While the new sustainable BlackRock LifePath ESG Index series improves its ratings in three of the seven issue areas, it is still invested in climate destruction and social inequity, leaving plenty of room for improvement.

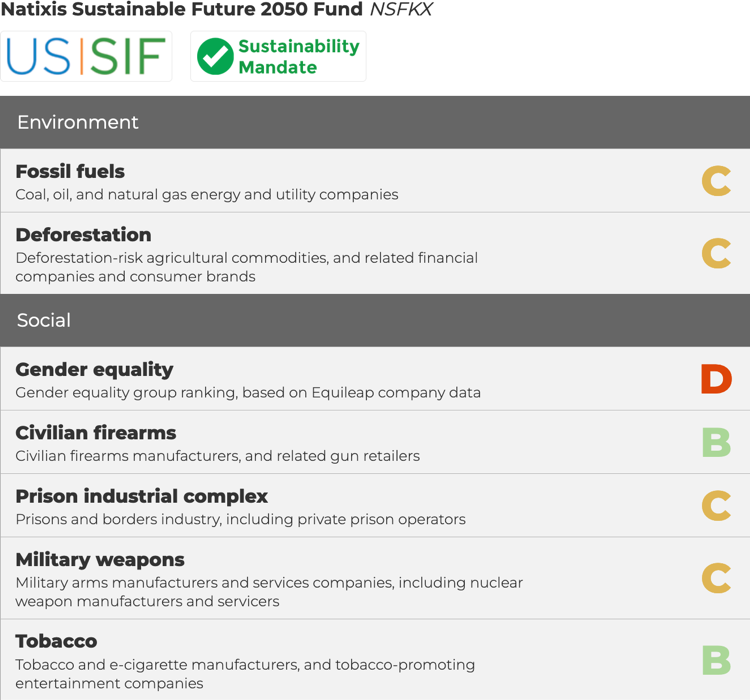

Other sustainable target date options

There are other ESG target date fund series available. For example, compared to the original non-ESG BlackRock LifePath Index series, the Natixis Sustainable Future series earns better grades across almost all issues areas.

Since target date funds are the default option in many 401(k) plans, it’s important that they are addressing climate and other sustainability risks. Unsustainable investments carry financial risk – from stranded assets, reputational risk, and other negative impacts of unsustainable business practices – and making sure retirement plans are sustainable by default protects people from that risk.

Next steps

Is your employer-offered 401(k) or similar retirement plan invested in target date funds like the BlackRock LifePath Index series? You can follow these simple steps to engage your workplace and secure a climate safe retirement plan.

To find more funds that avoid fossil fuel investments, check out our Fossil Free Funds database.