Sustainable investing has been growing fast, as people look to align their personal portfolios and 401(k)s with their personal values. Since we launched in 2015, Fossil Free Funds has grown too, making improvements like tracking the carbon footprint of every fund in our database.

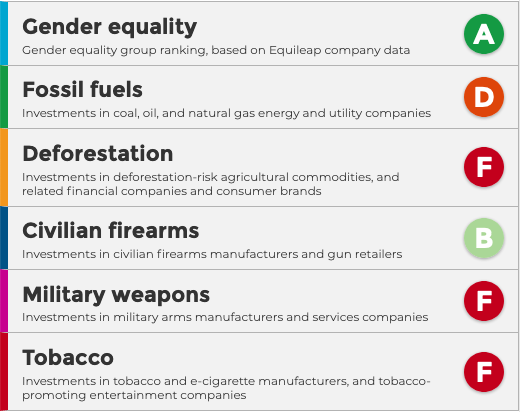

Now, we’re growing again. We’re excited to announce our first-of-its-kind Sustainability Report Card, grading investments not just on fossil fuel exposure, but also deforestation risk, gender equality, weapons, and more.

Six environmental and social issues

The sustainability report card brings together data from As You Sow’s suite of six Invest Your Values tools. The new report card allows investors to easily see in one place if your 401(k) options or personal portfolio is invested in:

- Fossil fuels, including coal-fired utilities, pipelines, and oil field services.

- Companies contributing to the destruction of the Amazon and Indonesian rainforests by producing palm oil, beef, soy, timber, rubber, or paper/pulp.

- Companies with poor gender equality policies.

- Assault weapons, ammunition, cluster munitions, nukes, and military grade weapons.

Sustainability report card results for an S&P 500 fund. While the fund earns a high grade for gender equality, it earns lower grades in fossil fuels, deforestation, and military weapons.

Impact alongside returns

These tools are about offering investors insight into the environmental and social impact of their portfolios, alongside traditional metrics like financial returns. The updated search page helps investors find mutual funds and ETFs that match their values, and have financial returns that beat the market.

Investors can use Fossil Free Funds to search for funds that earn the highest annualized returns, and the highest grades for the issues that matter to them. Each fund is compared to benchmark indexes like the S&P 500 on financial performance and sustainability results.

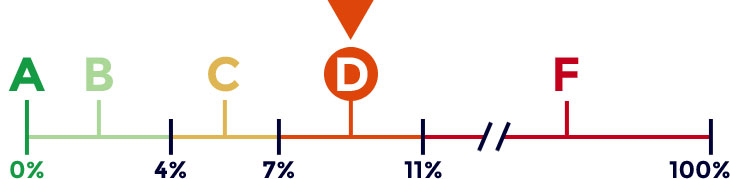

New fossil fuel grades

As part of building the sustainability report card, we’ve also added a new grading system to Fossil Free Funds. Funds can earn an “A grade” by avoiding investing in any of the fossil fuel companies we track. Funds that have fossil fuel exposure earn between a “B”, “C”, “D”, or “F” grade based on the level of their exposure. Read all the details on our updated How it Works page.

New fossil fuel grade results for an S&P 500 fund. Fossil fuel exposure of 9.24% places the fund in the D grade range of between 7% and 11% exposure.

As You Sow’s Invest Your Values suite of tools are free to use, and were built to encourage investors to move their hard-earned savings to funds that are aligned with their values. Not sure where to get started? Check out our action toolkit explaining how individuals can talk with their financial advisor or retirement plan manager to add sustainable investment options.

"These tools empower every investor, from employees with a 401(k) retirement plan to individual investors, to know what they own so they can invest in a future that they want to live in."

- Andrew Behar, As You Sow CEO