You care about climate change, and you care about investing in climate-safe companies. We do, too. That’s why As You Sow built Fossil Free Funds, a website dedicated to helping you find investment options that avoid companies with large carbon footprints, including major fossil-fuel producers, coal-based utilities, and coal mining companies, and to find funds that invest in companies with low greenhouse gas footprints.

There’s a common myth that says moving your money away from increasingly risky fossil fuel investments means having to sacrifice returns. But it’s not true. There’s a growing body of evidence indicating that investing in funds with fewer fossil fuel holdings does not mean making less money.

Fossil free investing doesn’t mean having to sacrifice returns

“The fossil fuel sector is shrinking financially, and the rationale for investing in it is untenable...”

- Institute for Energy Economics and Financial Analysis 1

Is there a financial penalty associated with dramatically reducing fossil-fuel investments? MSCI didn’t find one in a study spanning from 2010 to 2017, instead finding that investors who avoided coal, oil, and gas during the period would have earned a higher annualized five-year return than those who kept the fossil fuel companies in their portfolio. 2

New on Fossil Free Funds: Annualized financial returns

Fossil Free Funds now shows the annualized financial returns for every fund in our database. That’s new!

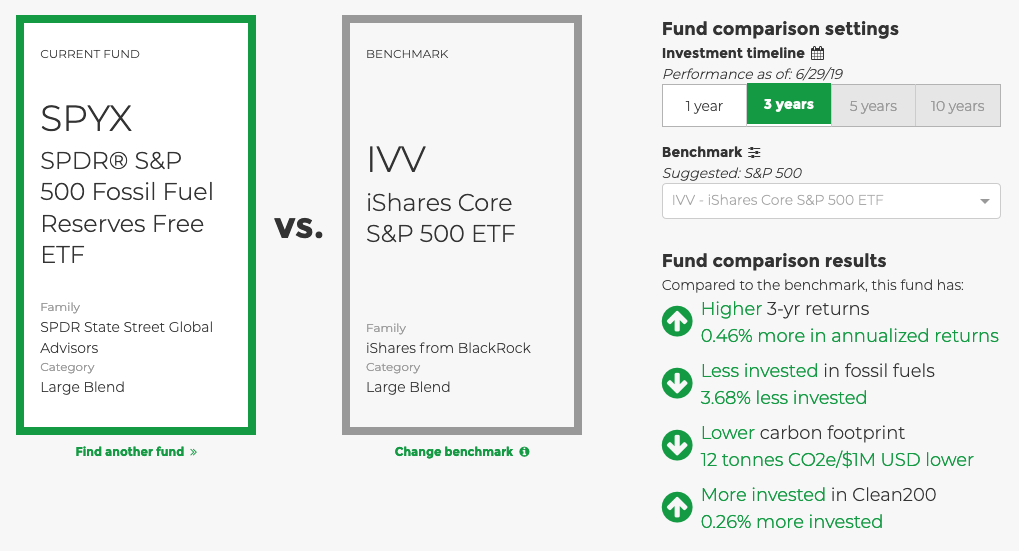

Each fund can be compared to a benchmark suggested by Morningstar, and you’ll see if your fund did better or worse than the benchmark on both returns and climate-related metrics like fossil fuel exposure and carbon footprint. You can choose from a list of other common benchmarks to adjust your comparison.

Comparing State Street Global Advisors’ S&P 500 Fossil Fuel Reserves Free ETF to the normal S&P 500: Since the fund was launched 3 years ago, the Fossil Fuel Reserves Free version of the S&P 500 index has outperformed the benchmark. It’s done this with a portfolio less invested in fossil fuels and with a lower amount of financed carbon emissions. (Data as of 6/29/19)

If you aren’t satisfied with the results of your current funds, you can use our search page to find alternative investment options that fit your needs.

Looking for more financial data beyond annualized returns? You can also click through to each fund’s Morningstar page to find more information on financial metrics like expense ratio and fees.

Get started

People seek to move away from fossil fuel investments for different reasons. Some are trying to send a clear signal to financial institutions and governments by demanding action on climate change as a necessary criteria for investment. Others are worried that their investments may lose value if the fossil fuel industry faces climate-related financial risks, such as stranded assets or lack of demand. But everyone is hoping their savings will grow.

With Fossil Free Funds, you can search for investments that avoid fossil fuels and have low carbon footprints while outperforming their benchmarks on financial returns. Get started today at fossilfreefunds.org.

1: The Financial Case for Fossil Fuel Divestment, Institute for Energy Economics and Financial Analysis

2: Make a Clean Break: Your Guide to Fossil Fuel Free Investing, 350.org, Green Century Funds, Trillium Asset Manager