Employer-offered defined contribution retirement plans, like 401(k)s and 403(b)s, are designed to help workers save for retirement by letting them choose from different plan options to invest contributions from their paycheck, often with a match from their employer. Many might associate these plans with corporate workplaces, but non-profit institutions like universities offer them as well. Unfortunately, like corporate retirement plans, university plans are often heavily exposed to risky investments in fossil fuels, military weapons, and the prison industrial complex.

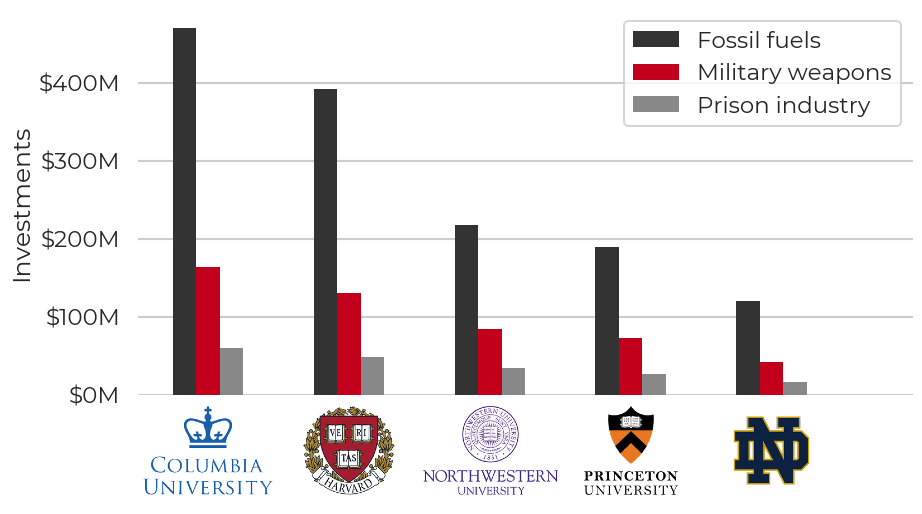

We analyzed 10 defined contribution plans offered by five large universities: Columbia, Harvard, Northwestern, Princeton, and Notre Dame. Retirement plans use a Form 5500 to report their investments to the SEC. By cross-referencing 5500 filings with data on mutual fund holdings, we found that billions of dollars in university employee retirement savings are invested in companies with significant environmental and social risks: fossil fuel companies like ExxonMobil, military weapon manufacturers like RTX Corp, and private prison operators like CoreCivic.

Figure 1: University defined contribution plan investments in fossil fuels, military weapons, and prison industrial complex companies. Details on the plans analyzed are in the methodology section below.

TIAA CREF and Vanguard

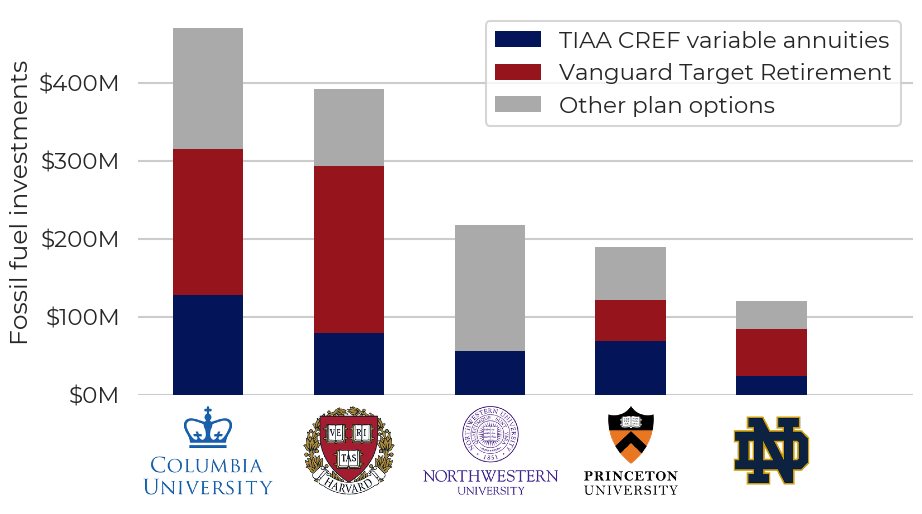

Two main culprits emerged – TIAA CREF variable annuities, and Vanguard Target Retirement funds.

TIAA CREF variable annuities - Variable annuities are technically insurance products, but they are structured similarly to mutual funds, with an underlying portfolio of stocks and bonds. CREF annuities from TIAA control substantial percentages of all the defined contribution plans analyzed and are responsible for a significant amount of the overall exposure to fossil fuels, weapons, and prisons.

Vanguard Target Retirement - Target date funds from Vanguard are responsible for another significant chunk of risky investments. These funds are built from index funds that invest in every company traded on stock markets, virtually ensuring there will be exposure to fossil fuels, weapons, and prisons.

The chart below shows the breakdown of fossil fuel investments to show how much is coming from TIAA CREF variable annuities and Vanguard Target Retirement funds. For four of the five universities, over 60% of fossil fuel investments come from these two fund groups.

Figure 2: University defined contribution plan investments in fossil fuels, broken down by fund groups.

Your savings, your choice

Investments in 401(k)-style plans are separate from those made by university endowments, or other university retirement systems like defined benefit pension plans, both of which also invest heavily in fossil fuels, weapons, and prisons. What’s different about 401(k)-style plans is that participants have a choice in where to direct their savings.

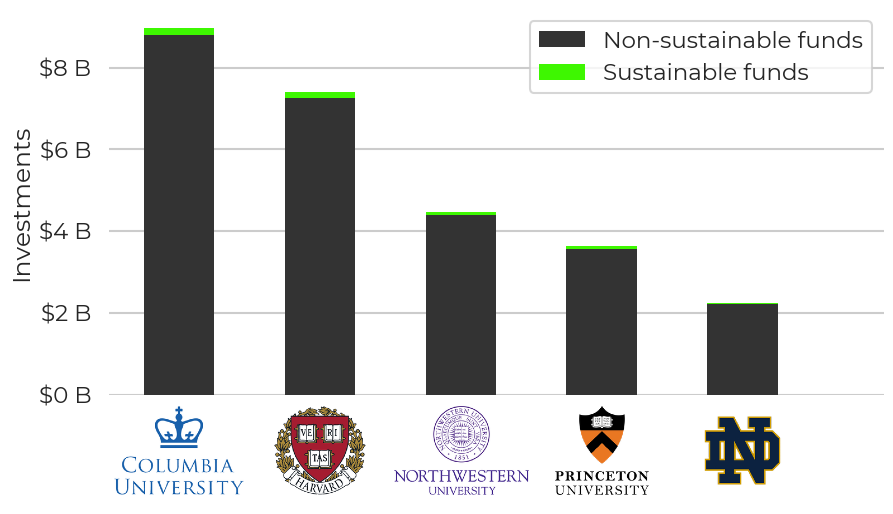

In fact, all the defined contribution plans we analyzed offer sustainable options with reduced exposure to these risky sectors. But few participants seem to avail themselves of those options, as investments in sustainable funds are dwarfed in comparison to the amount invested in non-sustainable CREF annuities, Vanguard target dates, and other funds.

Figure 3: University defined contribution plan investments in funds that market as sustainable investments.

Educators are investors

Fossil fuels, weapons, and prisons are risky investments not only to the stakeholders impacted by those companies’ operations, but also to their own investors, as their negative environmental and social impacts pose material investment risks. Professors and employees of major universities are (perhaps unwittingly) directing their investments into these risky sectors, with the help of CREF annuities and Vanguard target date funds.

Do these institutions understand that they are out of alignment with their own stated sustainability and justice statements? Do educators understand the financial risks involved? Do they believe these investments are in alignment with their commitment to their students? Do students understand their teachers are profiting from destructive industries?

Educators: take control of your savings!

Universities should consider the impacts of managing their retirement systems in a way that destroys the future their students are supposed to graduate into. Is this in alignment with their fiduciary duty to manage their retirement plan in the best interest of plan participants?

The negative environmental and social impacts of fossil fuels, military weapons, and private prisons pose material investment risks. Universities have a responsibility to address this risk by ensuring employee savings are invested with a view towards long-term sustainability.

Educators and university employees have the power to change where their investments are directed. They can find sustainable options in their plan with reduced exposure to risky sectors, and they can work with their colleagues to advocate for a more sustainable retirement plan.

Want to get started moving your investments? Check out our action toolkit for employees to learn what you can do to shift your savings towards sustainability.

Methodology

For this analysis, we looked at 10 defined contribution plans from five major US universities. Many employers offer multiple defined contribution plans, with different groups of employees eligible for different plans.* The plans selected for the analysis are among the largest university defined contribution plans in the US. All the plans we looked at controlled over $1 billion in employee savings. A detailed profile of each plan can be found on our Retirement Plan Sustainability Scorecard.

| Employer | Plan | Assets | Source data |

|---|---|---|---|

| Columbia University | Retirement Plan for Officers of Columbia University | $5,026,291,682 | Form 5500 |

| Columbia University | Columbia University Voluntary Retirement Savings Plan | $4,133,404,494 | Form 5500 |

| Harvard University | Harvard University Tax Deferred Annuity Plan | $3,765,660,720 | Form 5500 |

| Harvard University | Harvard University Defined Contribution Retirement Plan | $2,165,044,645 | Form 5500 |

| Harvard University | Retirement Income Plan for Teaching Faculty of Harvard University | $1,763,325,967 | Form 5500 |

| Northwestern University | Northwestern University Retirement Plan | $4,022,176,874 | Form 5500 |

| Northwestern University | Northwestern University Voluntary Savings Plan | $1,097,583,063 | Form 5500 |

| Princeton University | Princeton University Retirement Plan | $2,131,527,701 | Form 5500 |

| Princeton University | Princeton University Retirement Savings Plan | $1,532,776,551 | Form 5500 |

| University of Notre Dame | University of Notre Dame 403(b) Retirement Plan | $2,360,767,219 | Form 5500 |

We grouped the plans by employer for the purpose of tracking investments in fossil fuels, military weapons, and prisons. To track investments, we used the Form 5500 filings, which list the investments of each plan. All the Form 5500 filings we used are the most recent available for these plans, filed in 2024.

We mapped the investments in these filings to our database of mutual fund holdings and then cross-referenced these holdings with our database of fossil fuel companies, military weapon manufacturers, and prison industrial complex companies. (For this analysis, we used our “high risk” list of prison industrial complex companies – companies with a high level of involvement in prison industrial complex activities.) The mutual fund holding data is the most recent available as of 31 Dec 2024.

Figure 1 represents the aggregate USD amount invested in stocks from these companies across all the plan options offered by each employer’s plans. Some investments are classified under more than one category (e.g. a company active in both military weapon manufacturing and the prison industrial complex), so the sum of the three totals (fossil fuels, weapons, prisons) may be more than the total investment amount by the university plans. The figures show equity ownership, and do not include bonds issued by companies involved in these sectors.

Figure 2 represents the breakdown in fossil fuels investments across three groups: fossil fuel investments coming from CREF variable annuities, from Vanguard Target Retirement funds, and from other plan options. The CREF variable annuities group includes the CREF Stock Account, the CREF Growth Account, the CREF Global Equities Account, the CREF Equity Index Account, and the CREF Social Choice Account. The Vanguard Target Retirement group includes the Vanguard Target Retirement 2070 Fund, 2065 Fund, 2060 Fund, 2055 Fund, 2050 Fund, 2045 Fund, 2040 Fund, 2035 Fund, 2030 Fund, 2025 Fund, 2020 Fund, and Income Fund.

Fossil fuel investments (in USD)

| Employer | TIAA CREF variable annuities | Vanguard Target Retirement | Other plan options | Total |

|---|---|---|---|---|

| Columbia University | 128.2 M | 186.8 M | 154.7 M | 469.7 M |

| Harvard University | 79.4 M | 213.9 M | 98.7 M | 392.1 M |

| Northwestern University | 56.2 M | 0.0 M | 160.8 M | 217.1 M |

| Princeton University | 69.4 M | 51.5 M | 68.6 M | 189.5 M |

| University of Notre Dame | 23.5 M | 61.2 M | 35.6 M | 120.4 M |

Military weapon investments (in USD)

| Employer | TIAA CREF variable annuities | Vanguard Target Retirement | Other plan options | Total |

|---|---|---|---|---|

| Columbia University | 51.4 M | 61.8 M | 57.3 M | 170.6 M |

| Harvard University | 31.1 M | 70.8 M | 34.3 M | 136.2 M |

| Northwestern University | 22.6 M | 0.0 M | 66.3 M | 88.9 M |

| Princeton University | 28.0 M | 17.0 M | 29.9 M | 75.0 M |

| University of Notre Dame | 9.5 M | 20.3 M | 13.5 M | 43.2 M |

Prison industry investments (in USD)

| Employer | TIAA CREF variable annuities | Vanguard Target Retirement | Other plan options | Total |

|---|---|---|---|---|

| Columbia University | 12.8 M | 22.6 M | 24.7 M | 60.2 M |

| Harvard University | 8.0 M | 25.9 M | 15.0 M | 48.9 M |

| Northwestern University | 5.7 M | 0.0 M | 28.7 M | 34.4 M |

| Princeton University | 7.1 M | 6.2 M | 13.2 M | 26.6 M |

| University of Notre Dame | 2.4 M | 7.4 M | 6.1 M | 15.9 M |

Sustainable fund investments (in USD)

| Employer | Sustainable funds | Non-sustainable funds |

|---|---|---|

| Columbia University | 172.1 M | 8,790.9 M |

| Harvard University | 146.4 M | 7,266.8 M |

| Northwestern University | 88.3 M | 4,389.4 M |

| Princeton University | 91.7 M | 3,557.5 M |

| University of Notre Dame | 26.3 M | 2,210.5 M |

A full description of our methodology for analyzing defined contribution plans can be found here.

* Harvard University offers an additional defined contribution plan, the Harvard University Retirement Plan, with over $1 billion in assets. This plan combines participant-directed accounts with non-participant directed accounts, so it was excluded from this analysis.