Our newest tool is shining a light on employer-offered retirement plans’ exposure to fossil fuel bond holdings. Information on these holdings is critical because coal, oil, and gas companies are increasingly turning to the bond market to access inexpensive debt for new extraction and pipeline projects.

Check out the new tool »

Your 401(k) savings may be directly financing fossil fuel expansion

Bond issuances are one of the main ways fossil fuel companies raise capital to expand operations. The International Energy Agency has warned that there can be no new coal, oil, and gas development if humanity wants to prevent dangerous warming. If there are fossil fuel bonds in your 401(k), you’re effectively lending your retirement savings to companies so they can mine for coal and drill for oil. In this way, you’re funding operations that are generating higher emissions and thus contributing to the higher risks faced by the entire portfolio from climate change.

“If there are fossil fuel bonds in your 401(k), you’re effectively lending your retirement savings to companies so they can mine for coal and drill for oil.

Here’s the good news: our newest tool exposes fossil fuel bonds hidden inside 401(k) plans

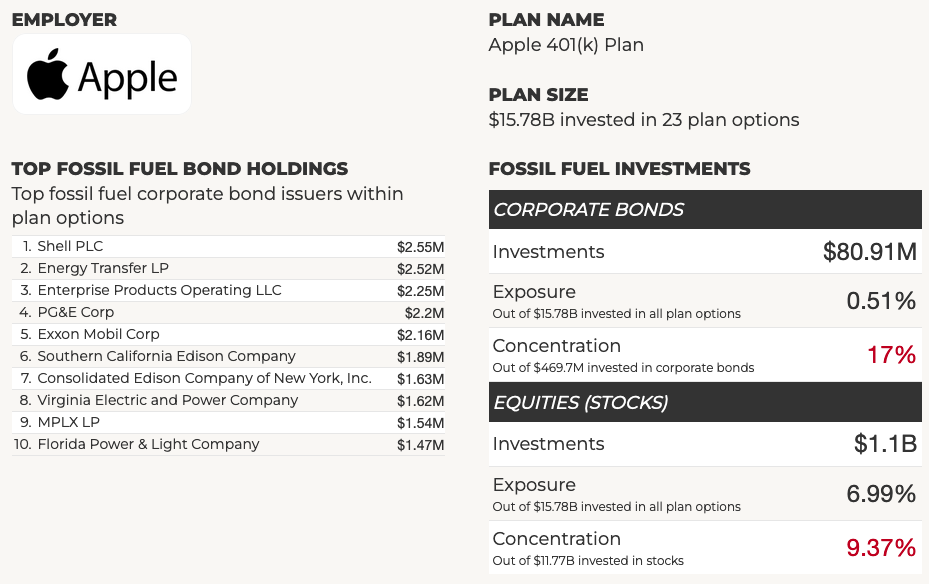

Fossil fuel companies issue bonds to raise money to develop new coal, oil, and gas projects. Retirement plans invest employee savings in those bonds. Now, we’re shining a light on these risky investments. Employees can find out the total dollar amount and percent exposure invested in corporate fossil fuel bonds by their retirement plans, see some of the top fossil fuel bond holdings in the plan, and see a breakdown of all plan options to see which have the most exposure.

A screenshot of the results for Apple’s 401(k). This retirement plan has millions invested in bonds from fossil fuel companies like Shell and Exxon.

We also tracked fossil fuel bonds across 10 popular target date series These target date funds, from asset managers like Vanguard and BlackRock, are some of the most popular investments for 401(k) plans, often used as the default investment option. Even if we haven’t rated your employer’s plan, you can use our new tool to look up your target date fund to find its exposure to fossil fuel bonds and stocks.

Key findings

While retirement plans have more invested in fossil fuel stocks than fossil fuel bonds, we found that the concentration of fossil fuels within the corporate bond asset class was double the concentration within stocks - in other words, any given corporate bond holding was about twice as likely to be fossil fuel than any given stock holding. None of the retirement plans analyzed offered sustainable bond funds seeking to minimize climate-related financial risks. Older employees are likely to have higher exposure to fossil fuel bonds, because as investors get closer to retirement, their allocation usually becomes more bond-heavy, meaning their risk of investing in fossil fuel bonds rises.

Companies can step up and offer employees climate-safe investments

In order to protect employee savings and the environment, retirement plan administrators should add climate-safe bond fund options; measure and reduce the climate risk of corporate bond holdings in the plan’s default option (where new plan participants are invested unless they specify otherwise); and engage asset managers like Vanguard, BlackRock, and State Street who are responsible for many of the portfolios offered by 401(k)s, letting the firms know about employee demand for sustainable, climate-safe investment options. Surveys have found that nearly 75% of plan participants would or might increase their overall 401(k) contribution rate if offered sustainable fund options, and 40% say having those fund options would improve how they view their employer.

By reducing exposure to fossil fuel bonds, investors can reduce climate-related financial risk while sending a powerful message that they will no longer use their money to invest in climate destruction.