The investing giant plays a major role funding carbon polluters

Vanguard is one of the world’s largest asset managers, handling the retirement savings of millions of Americans. Its mission is to help people save for the future. At the same time, it’s playing a major role directing billions in funding to carbon polluters — companies maintaining and expanding the fossil fuel infrastructure that threatens to make the future uninhabitable.

Fossil fuel stock prices are based on oil reserves that will not actually be burnable if we expect to avoid catastrophic effects due to climate change. Countries are already moving to restrict emissions and transition to clean energy alternatives. Money invested in fossil fuel infrastructure is likely to become ‘stranded assets’.

But Vanguard doesn’t seem to recognize the economic risks of climate change, because our Fossil Free Funds analysis shows that Vanguard funds are heavily invested in coal, oil, and gas.

Coal, oil, gas investments

The firm, which manages over $4.5tn in assets, has grown famous for its passive investing options tied to benchmark indices. Unfortunately, those popular low-priced index funds are more limited in fossil free investing options, since the various markets indices often include even the worst offending companies.

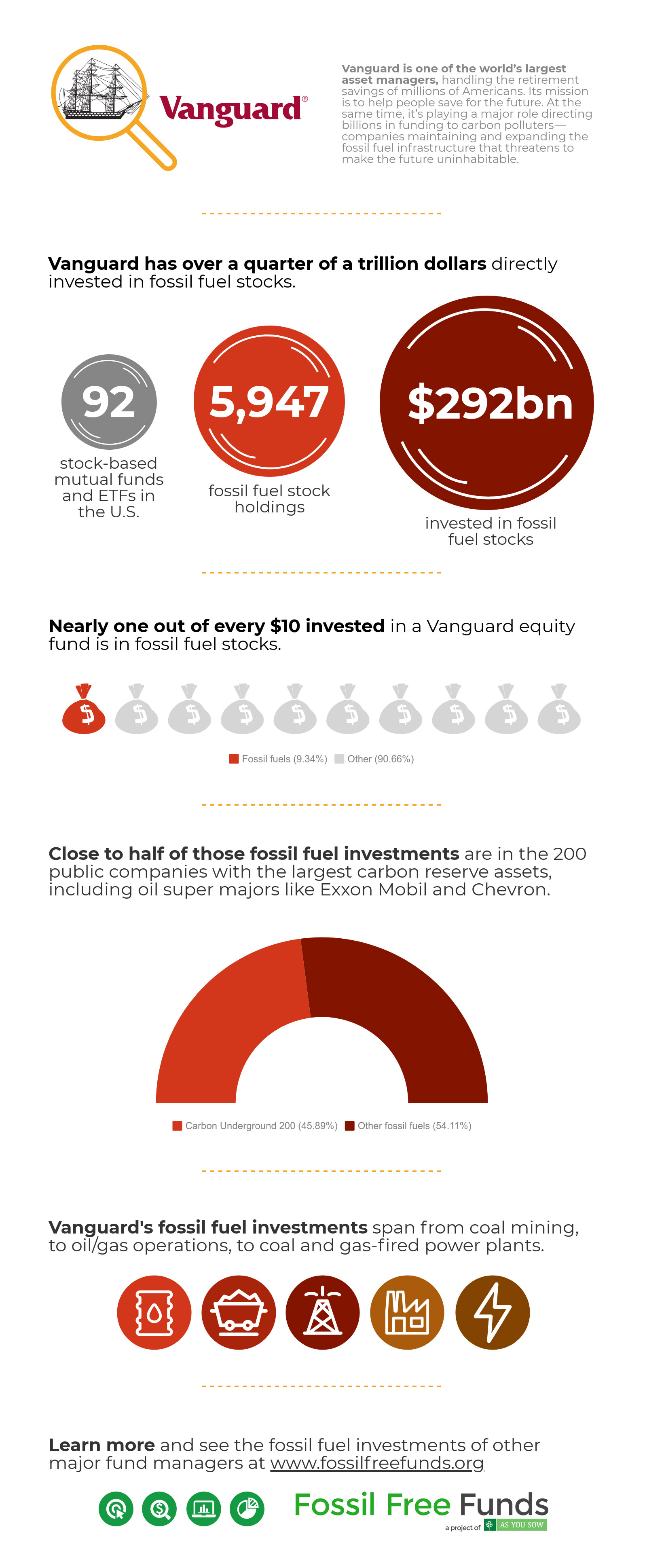

As of December 2017, Vanguard offers 92 stock-based mutual funds and ETFs, valued at over $3tn, accounting for two-thirds of their total assets under management. Inside those funds we found nearly 6,000 separate investments in fossil fuel stocks.

Those stock holdings add up to over $292bn — more than a quarter of a trillion dollars invested in coal companies, oil/gas extraction, and coal and gas-fired utilities. The overall exposure was 9.34%, meaning nearly one out of every $10 invested in a Vanguard equity fund is in fossil fuel stocks.

Vanguard has more than a quarter of a trillion dollars invested in coal companies, oil/gas extraction, and coal and gas-fired utilities.

Of that, $133bn is invested in the Carbon Underground 200 — the 200 public companies with the largest carbon reserve assets, including oil super majors like Exxon Mobil and Chevron, and other companies deemed among the most responsible for human-caused climate change.

Fossil free alternatives

Vanguard does have options that avoid fossil fuels. However, they’re almost all sector-themed funds — funds that focus on a single sector like technology or real estate, not the diversified portfolios most preferred for retirement plans and 401(k)s.

Vanguard is behind the curve with only one socially responsible portfolio. That’s the Vanguard FTSE Social Index Fund, and with holdings in ConocoPhillips, Kinder Morgan, and other large oil companies, it’s hardly fossil free. But it’s the only mutual fund Vanguard offers with a responsible investing mandate.

The US Forum for Sustainable and Responsible Investment estimates that more than a fifth ($8.7trn) of the funds under professional management in America are screened on SRI criteria. At Vanguard, that figure is less than one-tenth of a percent. Contrast that with peers like State Street, who’ve launched a number of responsible funds in recent years, including funds that specifically avoid the Carbon Underground 200.

More than a fifth of the funds under professional management in America are screened on SRI criteria. At Vanguard, that figure is less than one-tenth of a percent.

The takeaway: If your retirement plan is restricted to Vanguard funds, there are precious few places to put your money that won’t end up financing fossil fuel infrastructure.

Climate votes

In the past, Vanguard leadership has pointed to engagement as a reason not to divest — if you sell your shares, you’re losing your ability to vote on issues at the company.

But at the same time, Vanguard has worked against those same engagement efforts. Historically Vanguard has voted with management and against climate change shareholder proposals. In fact, their own shareholders have asked Vanguard to be more transparent about how the company decides these climate votes.

Historically Vanguard has voted with management and against climate change shareholder proposals.

The tide may be shifting — this year Vanguard supported climate proposals opposed by the boards of directors at both Exxon and Occidental, leading to majority votes of 62% and 67% on climate planning resolutions. And other large investors like State Street, BlackRock, and Fidelity have also indicated a new willingness to go against the board on climate issues. More votes will be held this spring, and asset managers have a chance to match talk to action by supporting board-opposed climate proposals.

Vanguard’s most popular fossil fuel holding is Exxon-Mobil, with $26bn overall invested. That’s a significant fraction of Exxon’s $353bn total market cap, and it gives Vanguard a lot more votes than most investors to push back against climate-killing business as usual. Will they use it?

What needs to happen

Vanguard might want to look to Norway’s Sovereign Wealth Fund, which is moving to divest from fossil fuels because of financial risk. It needs to offer diversified options that let people keep their money out of fossil fuels.

For funds that own shares in fossil fuel industries, it’s time to make engagement mean something by holding boards of directors to account. Vanguard should use its voting muscle to make it known that business as usual is no longer an option.

If your savings are invested with Vanguard, you can use Fossil Free Funds to find out if your money is being funneled to coal, oil and gas companies. We track trillions of dollars in fossil fuel investments across thousands of mutual fund portfolios to help you know what you own and hold corporations accountable.