Fossil Free Funds is partnering with Macroclimate to expose hidden investments in coal power plants

Experts agree: when it comes to climate change, the #1 problem is coal. But unless you’re seeking out environmentally responsible investment options, it’s likely your savings are being invested in coal-fired utility companies — putting the planet and your finances at risk.

Retiring coal-fired power plants could be the most effective use of major investments to limit global warming. That’s why Fossil Free Funds combined forces with Macroclimate® to highlight investments in the most carbon-intensive utilities with coal-fired power plants — companies that can be found in nearly everyone’s retirement portfolio.

The climate and public health risks of coal add up to potentially large financial risks for utilities operating coal-burning power plants. Cleaner, safer energy sources are here today, and utilities that adopt these low-cost clean energy solutions are likely to be the most successful. Just look to Europe, where coal use is declining quickly as the cost of shifting to green energy plunges. Even in the U.S., where President Donald Trump has vowed to cut environmental standards to revive coal jobs, many plants can’t compete with cleaner alternative energy sources.

By incorporating Macroclimate’s® research into Fossil Free Funds’ transparency platform, you have a new lens into how your savings are being invested into companies contributing to climate catastrophe.

U.S. equity funds have $196 Billion in direct stock investments in Macroclimate 50 companies

The Macroclimate® 50 is a list of the 50 largest public-company owners of coal-fired power plants in developed markets plus China and India. Macroclimate® compiled the list of 50 companies using open-source data on coal-fired power plants worldwide. We analyzed over 5,000 mutual funds and ETFs and found $196 billion directly invested in Macroclimate® 50 companies.

See the list of 50 companies >

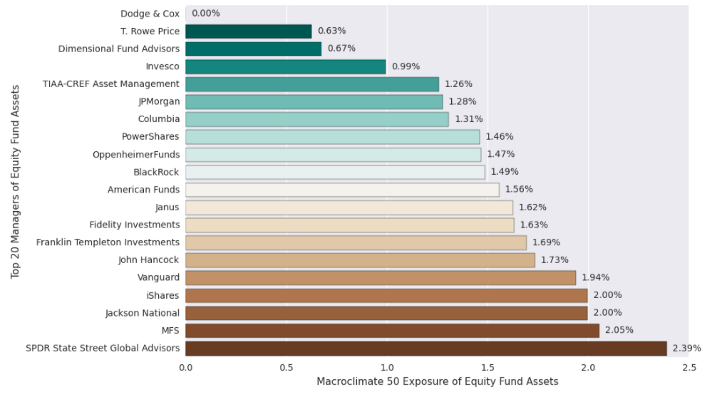

Not all asset managers are equally exposed

Exposure to Macroclimate® 50 direct stock investments by the top 20 U.S. equity fund managers. The firms had as low as 0% and as high as 2.38% of their analyzed assets invested in the 50 coal-fired utility stocks. See the chart data

How do different asset management companies stack up when comparing their ownership of these 50 utilities? Looking at the 20 largest managers of equity funds, Dodge & Cox was alone in having no direct stock investments in the Macroclimate® 50. Of those same 20 managers, SPDR State Street Global Advisors had the most overall exposure to the list of coal-fired utilities.

SPDR State Street Global Advisors was also last when we ranked the same 20 asset managers on their investments in Clean200 companies compared to their investments in Carbon Underground 200 companies. This may indicate that State Street, while making admirable strides on social issues like gender diversity in corporate board rooms (we are big fans of the “Fearless Girl” statue), is lagging behind its peers on exposure to both carbon reserve-owners and coal-fired utilities.

Cleaner, cheaper alternatives to coal are here today. Photo: iStockphoto

Coal is among the largest source of global warming pollution in the world. Obtaining it destroys mountains, burning it releases hazardous emissions, and disposing of it results in hazardous toxic waste.

By continuing to operate coal-fired power plants, these companies are emitting massive amounts of CO2 and fueling climate change — and given coal’s volatility and unsustainable business model, that makes them an increasingly risky investment.

Want to see the carbon risk and fossil fuel exposure embedded in your portfolio?

Head over to Fossil Free Funds where you can see if your savings are invested in dirty energy sources, and find investment options that support a cleaner, greener future. Learn more at fossilfreefunds.org.

Methodology

We source fund holdings and company industry data from Morningstar. The universe of funds we examined was restricted to equity and balanced portfolios with at least 40% of assets in direct stock holdings, offered as open-end mutual funds or ETFs, and domiciled in the U.S., numbering over 5,000 at time of publication. The data represents the fund holdings delivered by Morningstar in April 2017, with over 90% of portfolios dated 2016–12–31 or later. Learn more at fossilfreefunds.org/how-it-works.

Macroclimate®

Macroclimate® is a new kind of investment company: one that uses financial science, expert opinions of climate scientists, and state-of-the-art automation technology to help the general public invest better — in an environmentally-responsible way. For more information visit macroclimate.com.