Large companies are making increasingly strong commitments to address climate change by sourcing clean energy and reducing emissions in operations. But our research finds that their retirement plans are directing employee savings into fossil fuel companies that are fueling the climate crisis.

See the results »

We've rated the 401(k) plans of seven major S&P 500 companies, with more on the way.

In the 401(k) plans we’ve analyzed so far, the bulk of investments are in diversified index funds that don’t address the financial risks of climate change. The failure to provide employees with climate-friendly investment options poses financial risks to employees saving for retirement, and creates reputational risk for the company by directly contradicting their publicly stated corporate sustainability goals on climate change.

Few plans offer any sustainable options

Employees need access to sustainable investing. If a retirement plan doesn’t offer sustainable options, employees are being forced to assume the financial risks of unsustainable investing.

Of the seven plans analyzed so far, only two offered a sustainable fund option: Amazon and Disney. Both plans offered only one sustainable fund, and both had a small fraction of plan assets invested in that option (1.9% and 0.02% for Amazon and Disney respectively).

Large investors like pension plans, university endowments, and insurance companies have started moving to make sure their portfolios are properly addressing sustainability risks like climate change. But employer-offered retirement plans are not moving fast enough to shift towards sustainable investing – in part because asset managers like Vanguard, BlackRock, and Fidelity aren’t doing enough to help them shift.

Default options invest heavily in coal, oil, and gas

It is the responsibility of every company to ensure that the retirement plan offers sustainable investments. The problem is that the default option, which is rarely sustainable, is the simplest to join so most people opt-in without fully understanding that this means that their money is being invested into risk sectors like fossil fuels.

All of the plans analyzed so far had broadly diversified target date funds from Vanguard or BlackRock as the default option. None of these funds are fossil free or sustainably invested.

So long as the default option in a retirement plan is not invested sustainably, retirement plans will continue investing significant amounts of their employees’ savings in coal, oil, and gas companies that are failing to reduce their GHG emissions.

What companies should do

Two solutions are offered to address the risk of unsustainable investments — first, companies should work towards making the default investment option a sustainable fund, and second, companies should make sure sustainable investment options are at least offered in the retirement plan.

Employees who put away a portion of their hard-earned paycheck for retirement need sustainable investing options. Without fossil free investment options, plan participants are forced to assume financial risks associated with unsustainable investing.

Methodology

To rate 401(k) plans, first we find out what funds are offered by the retirement plan, using data from the Department of Labor.

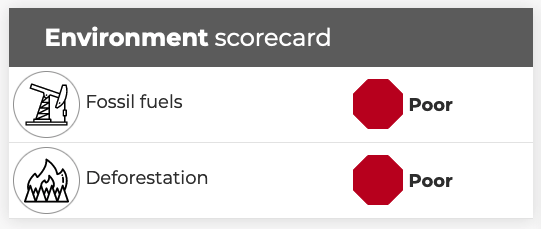

Then, we find out what companies those funds are invested in and apply the different fund ratings from Fossil Free Funds, Deforestation Free Funds, Gender Equality Funds, and our other mutual fund screener tools.

We produce an overall scorecard for each retirement plan based on the results for the default investment option.

An example of the environment scorecard for a retirement plan.

We add up the total amount invested by plan participants in fossil fuels and other risk categories across the different funds offered. For each investment option, you can click through to see the full results for fossil fuels, deforestation, or any of the issues we’ve rated it on.

We also check to see if there are any sustainable investment options offered by the plan. You can see the full methodology here.

As of October 2021, we’ve rated the retirement plans of seven of the largest companies on the S&P 500. We’ll be adding more in the coming months - sign up to get a notification when we add new companies to the database.