What if your savings could help save the world?

Fossil free investing has grown exponentially in recent years. Faith-based and individual investors led the way in using environmental and social criteria to align their investments with their values. Large institutional investors like foundations and company 401(k)s are starting to follow their lead. As Washington D.C.’s environmental regression has gained steam, investors large and small are loudly reaffirming commitments to a low-carbon economy.

You can make an impact with your investments

At As You Sow’s Fossil Free Funds, our mission is to provide the information you need so that your money can make a difference. You can calculate the climate exposure of your mutual funds and make investment decisions based on the specific fossil fuel companies in your portfolio.

The goal of this guide is to help you better understand the reasons to consider reducing fossil fuels in your investments, and to show you how to get started moving your money out of coal, oil and gas, and associated companies. Use our website as a tool to research, educate, and discuss going fossil free with your family, your workplace, or your financial planner.

- Why eliminate or reduce fossil fuels in your portfolio?

- Defining “fossil free”

- Know what you own

- Making a change

Why eliminate or reduce fossil fuels in your portfolio?

Align your investments with your values

Climate change is not a distant threat — it’s here, and it poses a significant threat to our families, communities, and planet. Many investors believe there is an ethical obligation not to profit from businesses that inherently accelerate climate change. Investors are also looking to fossil free investing to call attention to the fossil fuel industry’s role in creating global climate change and its influence over policymakers and the economy.

“Do your little bit of good where you are; it’s those little bits of good put together that overwhelm the world.” — Archbishop of South Africa Desmond Tutu

Avoid financial risk of fossil fuels

Renewable energy technologies are now cheaper than fossil fuels in many markets and are predicted to become cheaper and more widespread. At the same time carbon reduction measures such as energy efficiency and carbon pricing are being enacted in markets across the globe. It’s a quickly decarbonizing energy market, and fossil fuels are under pressure from all directions.

Despite facing a future of weakening demand and lower prices, energy companies are still pouring billions of dollars into finding and developing remote, high-cost, high-carbon reserves. These high-priced reserves are likely to end up stuck in the ground with billions in shareholder capital wasted. Investors are increasingly asking: will my savings be stranded too?

Reinvest in clean energy and climate solutions

Every day brings new evidence of the increasing cost-effectiveness of clean energy and renewables. There is a tremendous opportunity for carbon-free investing to fund energy efficiency and clean technologies and to speed the transition to a clean energy future.

Many companies working in energy, infrastructure, water, transportation, energy storage, air & environment, and agriculture are increasingly leading the way in adopting clean and green products, services, and related infrastructure worldwide. These leading companies are ensuring they remain competitive and retain value into the future.

It all adds up to investors realizing they can earn competitive returns while reducing exposure to the financial risk of fossil fuels.

Defining “fossil free”

There is no universally accepted definition for “fossil free investing”, but many investors look to exclude companies like:

- The top 200 fossil fuel companies by reserves

- The largest owners of coal-fired power plants

- Any company that explores for, extracts, processes, refines, or transmits coal, oil, and gas

- Any utilities that burn fossil fuels to produce electricity

At Fossil Free Funds, we let you choose from five different fossil fuel sectors, to craft the definition of fossil free that works for you. Each fund is eligible to earn up to five badges, indicating the portfolio is clean of any companies from each of the five company lists.

Look for these icons on Fossil Free Funds to find portfolios that are “five badge” fossil free: no major reserve owners, no major coal-fired utilities, no coal industry, no oil/gas industry, no fossil-fired utility industry.

Carbon footprinting

Companies emitting large quantities of CO2 have come under increasing levels of scrutiny for their large and direct responsibility for climate change.

A portfolio’s carbon footprint is calculated by tracking, measuring, and adding up the greenhouse gas emissions of every company held within a fund. Carbon footprinting is increasingly used by asset managers to assess climate impacts. Fossil Free Funds offers detailed carbon footprints for U.S. mutual funds, letting you calculate the emissions associated with your investments.

“Low carbon” is not synonymous with fossil fuel free. Funds marketed as “low carbon” may still own companies that explore for, extract, process, or refine coal, oil, and gas, or utilities that burn fossil fuels in order to produce electricity.

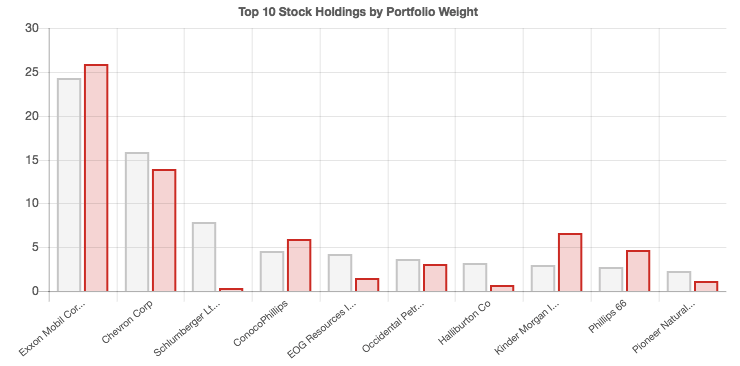

A portfolio’s carbon footprint is calculated using company emissions disclosures, company market capitalizations, and the amount invested by the fund. The example graph above shows the portfolio weight (grey bars) and emissions weight (red bars) for the top 10 stock holdings in a fund portfolio.

A portfolio’s carbon footprint is calculated using company emissions disclosures, company market capitalizations, and the amount invested by the fund. The example graph above shows the portfolio weight (grey bars) and emissions weight (red bars) for the top 10 stock holdings in a fund portfolio.

Socially responsible investing and shareholder engagement

Socially responsible funds make investment decisions based on environmental responsibility, human rights, or religious views. They may consider social issues such as diversity and gender equity, labor and employment policies, or others issues.

Some socially responsible funds go further, actively engaging with the companies they own, and taking actions such as filing shareholder resolutions, to drive social and environmental policy changes at the companies they invest in.

![]()

More funds are practicing socially responsible investing as millennial savers show a preference for impact investing.

Know what you own

The first step in intentional investing is to know what you own. If you’re ready to get started greening your portfolio, head over to Fossil Free Funds.

Search our database to find out if your money, in the form of individual mutual fund investments or an employer-provided 401(k), is invested in increasingly risky high-carbon funds or the companies that continue to extract, consume, and burn fossil fuels.

At Fossil Free Funds you can drill down into different fossil fuel industries and find the definition of fossil free that works for you. You can calculate the carbon footprint of your portfolio and compare it to a range of benchmarks. It’s a level of detail on a fund’s climate impact and exposure you won’t find anywhere else.

Socially responsible superstars

As of October 2017, we tracked 33 U.S. mutual funds that are both socially responsible and earn all five fossil free badges. These funds account for nearly $18 billion in assets under management and span the range from diversified large and mid-cap funds to cleantech sector portfolios.

See these funds and more on Fossil Free Funds ->

Making a change

The first step is knowledge. The next step is action. You may need to talk to your financial planner, asset manager, or your workplace HR representative to move your money or to increase your low carbon and fossil free investment options.

Some may initially resist action. Listen to what they have to say — but remember, at the end of the day it is your money. You have the right to ask questions about how your money is being invested, and to have more low carbon and fossil free investment options available.

Check out our Fossil Free 401k toolkit

How low carbon and fossil free are your 401(k) fund choices? Your 401(k) portfolio could be an engine for more positive impact.

Use our 401k Toolkit to learn how to add options to your employer-sponsored retirement plan that are sustainable and positioned for a future of cleaner, greener energy.

Support this work

We depend on your support to make this information publicly available to all. Make a gift today!

Sign up for updates from Fossil Free Funds to get alerted when our data is updated or new features are added.

Special thanks to 350.org, Green Century Funds, and Trillium Asset Management for their report Make a Clean Break: Your Guide to Fossil Fuel Free Investing, which inspired this article.