Most American workers know that a 401(k) can be an important building block of their retirement security. What fewer realize is that their hard-earned savings are often invested in fossil fuel companies and other high-emission businesses that are contributing to the climate crisis and face significant climate-related financial risks.

Here’s the encouraging news: employees are already taking action to protect their savings by choosing sustainable investment options in their 401(k) plans. Our new analysis estimates that by choosing a green 401(k) fund, U.S. employees are keeping a lot of money from being invested in fossil fuel companies.

Moving billions out of the high-carbon economy

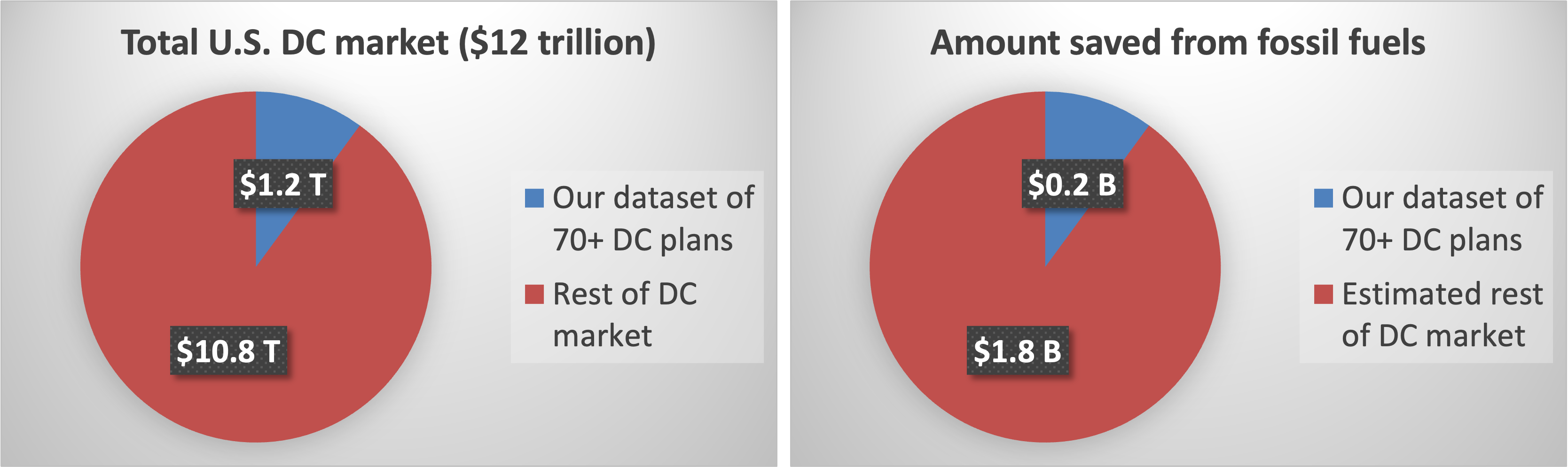

We analyzed over 70 defined contribution (DC) plans offered by major companies such as Google, Amazon, and Target, as well as universities like Harvard and Columbia. The plans amount to more than $1.2 trillion in employee savings. By looking at the actual fund options that employees selected within those plans, and comparing them to analogous index funds, we calculated how much less exposure to fossil fuels employees have when they choose the sustainable option.

What we found: across these plans, employees who chose the sustainable option have collectively shifted about $200 million away from fossil fuel companies. In other words, if those same employees had instead invested in standard market index funds (such as the S&P 500), their retirement savings would include $200 million more in fossil fuel stocks than they do today.

Because our dataset represents roughly 10% of the entire DC market (totaling about $12 trillion nationally), we can reasonably extrapolate this trend. That suggests employees across the U.S. have already shifted about $2 billion away from fossil fuels simply by selecting sustainable options in their retirement plans.

| Employer | Total saved from fossil fuel investments via sustainable funds |

|---|---|

| Adobe | $4,714,991 |

| Airbnb | $56,949 |

| Amazon.com | $47,441,204 |

| Atlassian | $255,901 |

| Bloomberg | $3,720,912 |

| Booking Holdings | $2,537,246 |

| Columbia University | $5,785,935 |

| Deloitte | $18,831,223 |

| Disney | $2,024,325 |

| Dollar General | $3,215,249 |

| Duke University | $4,629,321 |

| Etsy | $232,086 |

| $80,136,754 | |

| Harvard University | $8,873,998 |

| Intuit | $2,465,877 |

| Monster Energy Company | $885,564 |

| Northwestern University | $3,249,529 |

| Palo Alto Networks | $142,866 |

| $236,142 | |

| Princeton University | $2,963,128 |

| Prologis | $68,977 |

| Stryker | $1,291,082 |

| Sutter Health | $5,701,052 |

| Take-Two Interactive Software | $92,162 |

| Tesla | $1,085,303 |

| The New York Times | $1,095,725 |

| University of Notre Dame | $756,008 |

| Whole Foods | $1,475,800 |

| X Corp | $174,807 |

| Total | $204,140,114 |

Investing in fossil fuels is risky business

These employees are part of a broader global movement of investors, asset managers, and pension funds shifting capital from high-carbon business models and toward clean energy solutions. Despite partisan pushback on sustainable investing, a recent report finds that 75% of 401(k) investors want sustainable investment options. As demand for sustainable investing increases, employers are trying to meet their employees’ investment preferences by expanding their retirement plan offerings. Google replaced an existing fund that was underperforming, and they found that a fossil-free fund was a better replacement from a financial standpoint. If they instead went with a comparable index fund, those Googlers would have tens of millions more invested in oil majors, coal miners, and gas plants.

One big reason that matters: investing for retirement is first and foremost about financial returns. Fossil fuel investments face transition risk, regulatory risk, and physical risk from rising temperatures. We previously found that because of consistent financial underperformance (the fossil fuel sector has underperformed the S&P 500 in seven of the last 10 years) employees at 12 tech-sector companies could have earned an estimated $5 billion in additional returns. The financial performance of each company’s retirement plan holdings was estimated to have been higher on an absolute and risk adjusted basis if they had divested from the Energy Sector ten years earlier.

How you can invest in a sustainable future

If your 401(k) plan already offers a sustainable fund, use our Fossil Free Funds database to find out if it’s fully fossil-free. If it is, take the amount you have in that fund and multiply by 9% - that’s roughly how much you’ve kept out of fossil fuel investments compared to a basic index fund.

If your 401(k) doesn’t yet have a fossil-free sustainable option, don’t give up. You can use our action toolkit to learn how to work with your colleagues to ask your plan administrators to satisfy their fiduciary duty by offering investment options that mitigate climate-related financial risk. Together, employees have the power to shift billions away from fossil fuels and towards a more sustainable future.

The story here is simple but powerful. Employee choices matter. Retirement savings are not just passive; they shape the economy of the future. You can make meaningful financial decisions that align your retirement security with the realities of a warming planet and a changing economy.

How we did the analysis

Our retirement plan sustainability scorecard rates some of the largest U.S. retirement plans based on their investment exposure to environmental and social issues. We use Form 5500 filings, which companies are required to file with the government, to find details on plan assets.

The table linked here shows how we calculated the difference between the percentage invested in fossil fuels of each plan’s sustainable fund options against comparable index funds.