Fossil Free Funds now incorporates banks and insurers into our fossil fuel ratings. Financial companies are providing loans and underwriting that support fossil fuel projects – including tar sands, arctic drilling, and coal mining - but in order to keep global warming below 1.5°C, the world needs to rapidly transition away from fossil fuels.

Banks

Banks

Commercial and investment banks' carbon-intensive funding is fundamentally incompatible with reaching the 1.5-degree aligned global goal necessary to prevent catastrophic climate harm.

Insurers

Insurers

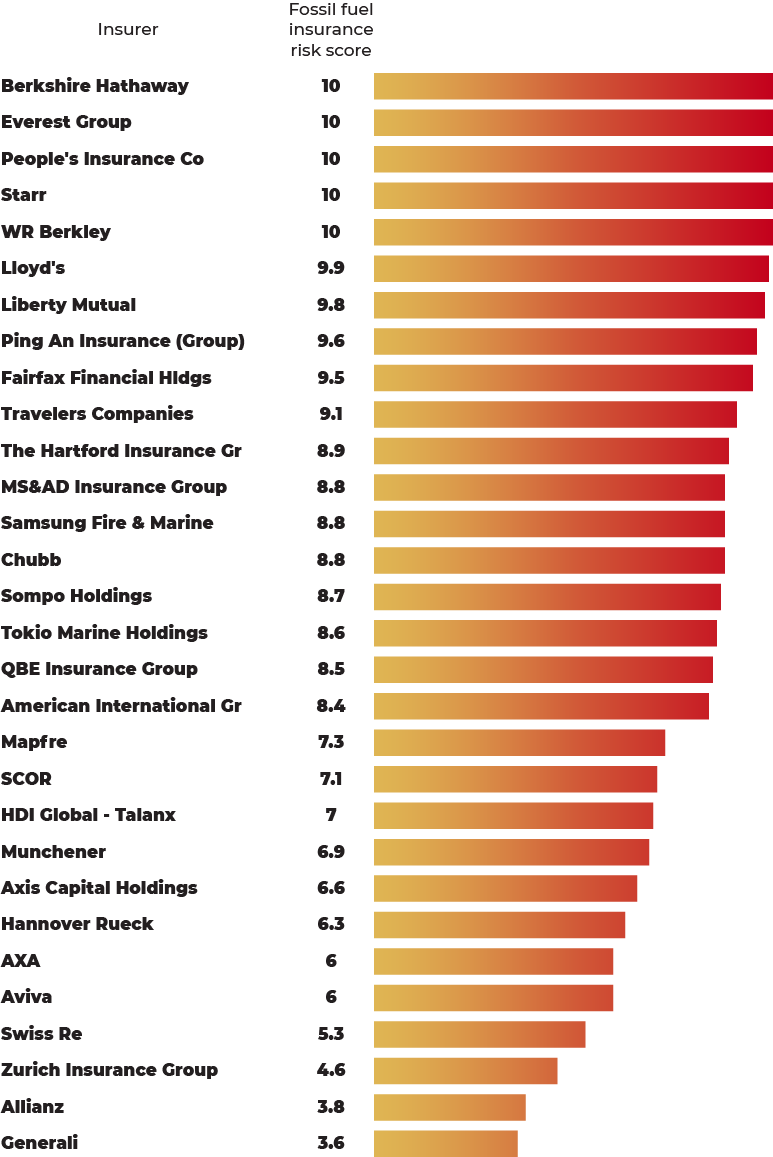

Primary insurers and reinsurers are continuing to underwrite and invest in coal, oil, and gas, while experiencing dramatic losses associated with catastrophic weather-related events.

Risky business

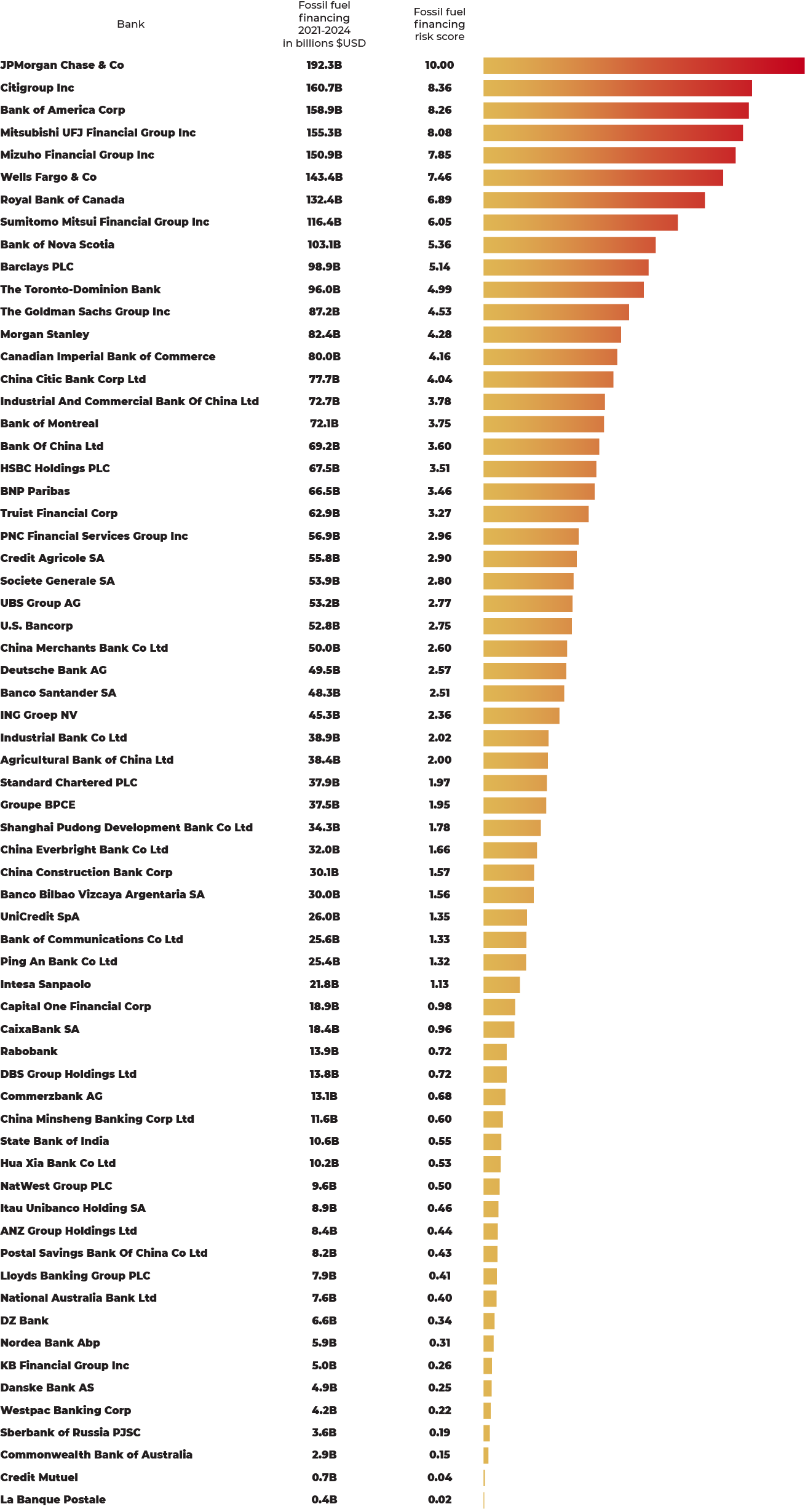

Since the Paris Agreement, the world's largest banks have provided trillions in financing to the fossil fuel industry.

By continuing to provide support to high carbon companies and projects, financial institutions are exacerbating the climate crisis, delaying the transition to a clean energy economy, and creating substantial portfolio risk for investors.

Climate change creates financial risk. Investors should be aware of which companies in their portfolios are contributing to those risks.

Fossil fuel finance

To rate mutual funds on fossil fuel finance, we use data from Banking on Climate Chaos. Banking on Climate Chaos looks at 65 of the largest commercial and investment banks and tracks their total fossil fuel financing: lending, and underwriting debt and equity issuances. The data covers 2021 through 2024. The top bank, JPMorgan Chase, had over $192 billion in fossil fuel financing over this time period. For our fund ratings, we normalize the bank financing amounts from $USD to a 0-10 scale, where 10 is the worst score possible. These 0-10 figures represent a company fossil fuel finance risk score.

If a fund invests in one of these banks, we flag the holding and display it on the fund profile.

We then use the normalized financing amounts (0-10 points) to calculate a fund fossil fuel finance risk score. For each flagged bank holding, the company risk score is multiplied by the holding weight (the percent of the fund's portfolio that holding accounts for). For example, if a flagged bank holding had a company risk score of 5, and made up 2% of the fund, 10 points would be assigned to the fund (5 x 2). These points are summed up and represent the fund fossil fuel finance risk score.

The last step is using the fund risk score to assign a fund fossil fuel finance grade. Funds are grouped into five tiers:

| Grade | Risk score |

|---|---|

A | 0 |

B | 0 - 11 |

C | 11 - 22 |

D | 22 - 35 |

F | 35+ |

These tiers are determined using the distribution of results for funds in the research universe (open-end mutual funds and exchange-traded funds domiciled in the U.S. with at least 50% invested in equities).

Funds with no exposure to the banks from the Banking on Climate Chaos report are assigned an A grade. For funds that do invest in these banks, the grade tiers roughly place 1/4 in the B tier, 1/4 in the C tier, etc.

In sum, the grades can be interepreted as saying: a fund with a worse grade has more exposure to banks from the Banking on Climate Chaos report, or exposure to banks with a higher financing amount, than funds with a better grade.

Fossil fuel insurance

To rate mutual funds on fossil fuel insurance, we use data from the Insure Our Future Scorecard. Insure Our Future looks at 30 of the largest primary insurers and reinsurers and rates their fossil fuel insurance underwriting policies. For our fund ratings, we normalize the insurance policy ratings to a 0-10 scale, where 10 is the worst score possible. These 0-10 figures represent a company fossil fuel insurance risk score.

If a fund invests in one of these insurers, we flag the holding and display it on the fund profile.

We then use the normalized policy ratings (0-10 points) to calculate a fund fossil fuel insurance risk score. For each flagged insurance holding, the company risk score is multiplied by the holding weight (the percent of the fund's portfolio that holding accounts for). For example, if a flagged insurance holding had a company risk score of 5, and made up 2% of the fund, 10 points would be assigned to the fund (5 x 2). These points are summed up and represent the fund fossil fuel insurance risk score.

The last step is using the fund risk score to assign a fund fossil fuel insurance grade. Funds are grouped into five tiers:

| Grade | Risk score |

|---|---|

A | 0 |

B | 0 - 9 |

C | 9 - 16 |

D | 16 - 24 |

F | 24+ |

These tiers are determined using the distribution of results for funds in the research universe (open-end mutual funds and exchange-traded funds domiciled in the U.S. with at least 50% invested in equities).

Funds with no exposure to the insurers from the Insure Our Future Scorecard are assigned an A grade. For funds that do invest in these insurers, the grade tiers roughly place 1/4 in the B tier, 1/4 in the C tier, etc.

In sum, the grades can be interpreted as saying: a fund with a worse grade has more exposure to insurers from the Insure Our Future Scorecard, or exposure to insurers with worse underwriting policy ratings, than funds with a better grade.

Disclaimer: As You Sow is not an investment adviser

See our full disclaimer