Just how much does the fossil fuel industry depend on our 401(k) savings? It turns out: quite a lot.

We estimated the total amount invested in U.S. fossil fuel companies by the retirement savings accounts of American workers. We then compared that to the total market cap of those companies and estimate that 19% comes from our 401(k)s and IRAs.

Market cap of U.S. fossil fuel companies

There are hundreds of publicly-traded fossil fuel companies in the U.S., ranging from oil & gas giants like Exxon Mobil to pipeline operators and oil field services.

The total market cap of U.S. stocks is $50.8 trillion. To model this market, we looked at the Vanguard Total Stock Market Index Fund (VTI), which covers the entire U.S. equity market and is weighted by market cap.

VTI has 8.9% exposure to U.S. fossil fuel companies. 8.9% of $50.8 trillion is $4.5 trillion. Thus, we estimate that the market cap for U.S. fossil fuel companies is $4.5 trillion.

How much do retirement accounts invest in U.S. companies?

There’s $9.9 trillion invested in 401(k)-style plans, also known as defined contribution plans. IRAs cover another $12.6 trillion. Together, these investment vehicles are the main way that millions of Americans save for retirement.

Much of this capital is opaquely invested, but we can use data on 401(k)s from Vanguard and others to model the fossil fuel exposure of these savings. Retirement accounts generally consist of combinations of mutual funds covering U.S. equities (also known as company stocks), international equities, domestic and international bonds, treasuries, and cash.

Vanguard says that 72% of the assets of their retirement plan clients were in equities. As one of the largest managers of 401(k) and IRA assets, we’ll use this figure as representative and assume the same of all 401(k) and IRA investments. That comes to $16.2 trillion invested in stocks by these accounts.

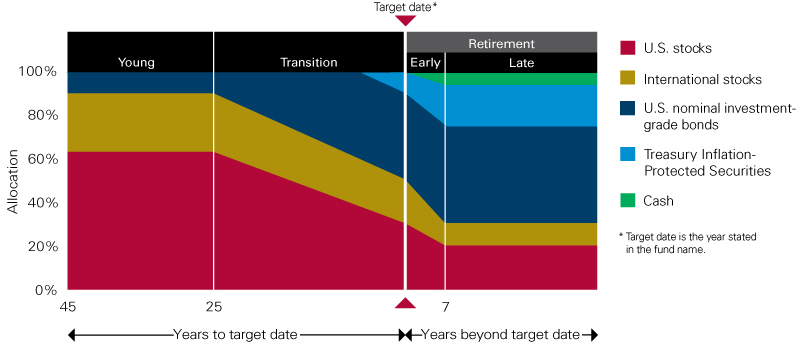

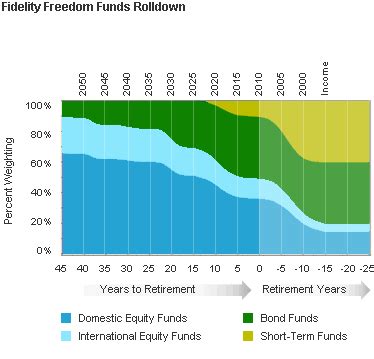

We’re measuring against market cap of U.S. fossil fuel companies, so we next want to know how much of those equity investments are in U.S companies. One way to do this is to look at target date funds that are popular in 401(k)s. Looking at the “glide paths” of popular target date line-ups, the breakdown for equities is approximately 60% U.S. stocks, 40% international stocks. The amount invested in stocks goes down over time, but this ratio between U.S. and international stays consistent. The Vanguard Target Retirement 2040 fund shows this relationship clearly.

We’ll assume that the equity holdings of the 401(k) and IRA markets have similar ratios, and estimate $9.72 trillion invested in U.S. stocks.

How much do retirement accounts invest in U.S. fossil fuel companies?

How much of that is invested in U.S. fossil fuel companies? Again looking at Vanguard as indicative of the broader market, the Vanguard Target Retirement 2040 fund is built around the same VTI Total Stock Market fund we used to model overall market cap of U.S. fossil fuel companies. We’ll use VTI to approximate the $9.72 trillion is invested in U.S. stocks by 401(k)s and IRAs.

This makes intuitive sense – as index investing has grown in popularity, the weighting of savings accounts portfolios has come to match overall market capitalization more and more closely.

Using VTI’s 8.9% fossil fuel exposure, we estimate that U.S. 401(k)s and IRAs have $863 billion invested in fossil fuels.

How much do retirement accounts invest in U.S. fossil fuel companies?

As a last step, we can take this estimate of $863 billion and compare it to our earlier estimate of U.S. fossil fuel market cap at $4.5 trillion.

The result: 19% of the market cap of U.S. fossil fuel companies is coming from investments in U.S. 401(k)-style defined contribution plans and IRAs.

Our takeaway: While many institutional investors across the U.S. are citing long term financial risk and reducing their high-carbon investments, the mutual funds that make up the bulk of investments in 401(k)s and IRAs are still heavily invested in fossil fuels.

The retirement savings of American workers continue to be exposed to the increasingly risky fossil fuel industry. A study from Mercer estimated that coal, oil, and gas stocks could face a decrease in annual returns of 9% through 2050.

Check your retirement accounts for fossil fuels

If you’d like to check your 401(k) or IRA funds for fossil fuel investments, our tools can help.

We analyze and rate thousands of mutual funds for fossil fuel exposure every month. We’ve also looked at the retirement plans of 50+ major U.S. companies and found billions in fossil fuel investments from employees at Google, Microsoft, Comcast, Disney, among others.

It’s all part of our mission to highlight unsustainable investments in our financial systems. If you’d like to join the effort for sustainable retirement plans, check out our five-step action toolkit.